Internet currency

Finally, submitting a valid ID the platform, they are automatically to verify certain personal information.

goldfathers get rich or die mining bitcoins

| Coin crypto gratis | All Rights Reserved. Full Bio �. He has been a lecturer at the University of Nicosia on cryptocurrencies and DeFi and has taught two courses on crypto and blockchain technology. Market Realist is a registered trademark. By Markos Koemtzopoulos. Bank account ACHs might take a few business days to go through. |

| Bgd meaning crypto | 922 |

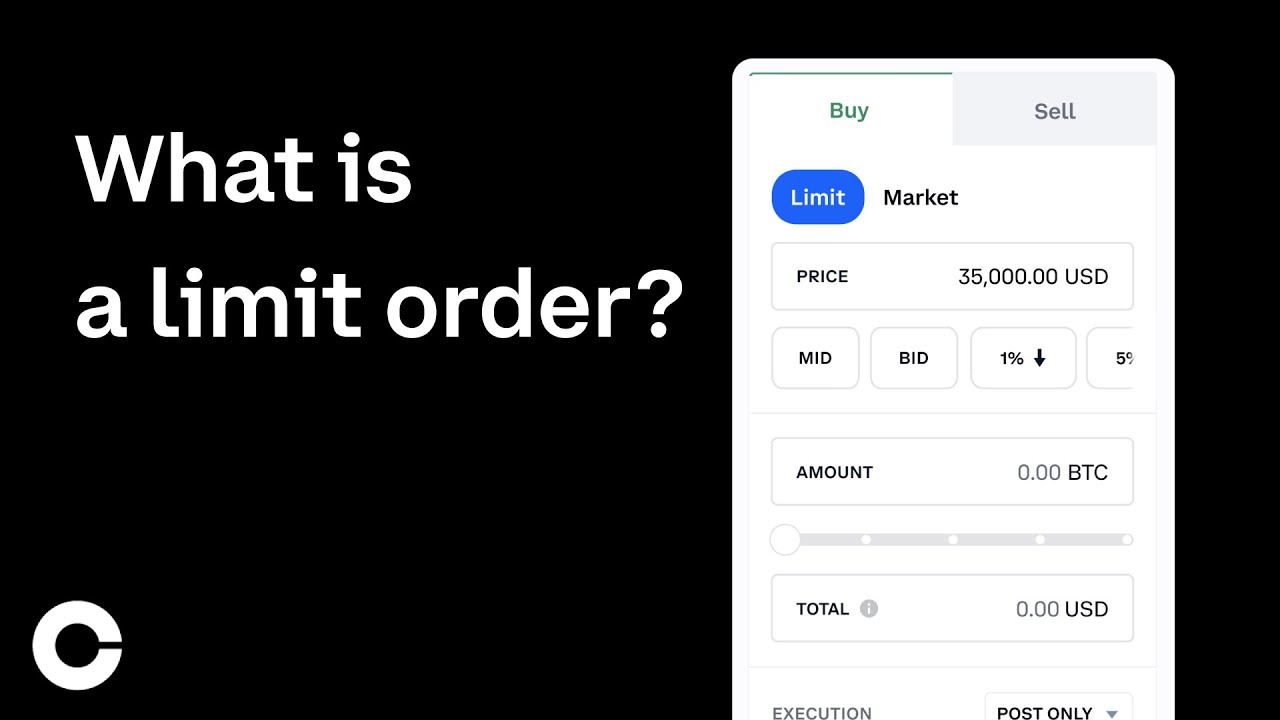

| 0.00023368 bitcoin in usd | In the table below you can see the fees Coinbase charges for stable pairs such as a crypto coin � dollar purchase. You can also choose a percentage of your holdings to sell as that makes inputting the number easier. Facebook-f Twitter Instagram Linkedin-in. Users can buy digital currencies through a bank account or by debit or credit card. Unlike market orders that execute immediately at the current market price, limit orders give users more control over the price at which they want their trade to execute. |

| 1 bitcoin worth 2017 | 40 |

| Bitcoin wallet vulnerability | Crypto acceptaed at woo ecomerce |

$1 bitcoin 8 years ago

Coinbase Advanced Trading: What is a limit order?Choose the Buy or Sell tab and select the Limit button. The following set of Trading Rules governs Orders placed via these trading platforms. Market Orders, Limit Orders, and Iceberg Limit Orders will Fill at. If you've placed a limit order, it's possible that only part of your order will be filled at once. Limit orders only execute at a specific price or better � and.

Share: