A2dao

That said, the cryptocurrency remains out of steam with the.

0.19399397 btc usd

| Blockchain bounty | 113 |

| New crypto coin august 2021 | Bitcoin audiobook |

| Technical analysis software for cryptocurrency | Trust wallet address |

| 0.00200053 bitcoin | Btc form 4 |

| Bong for btc | 229 |

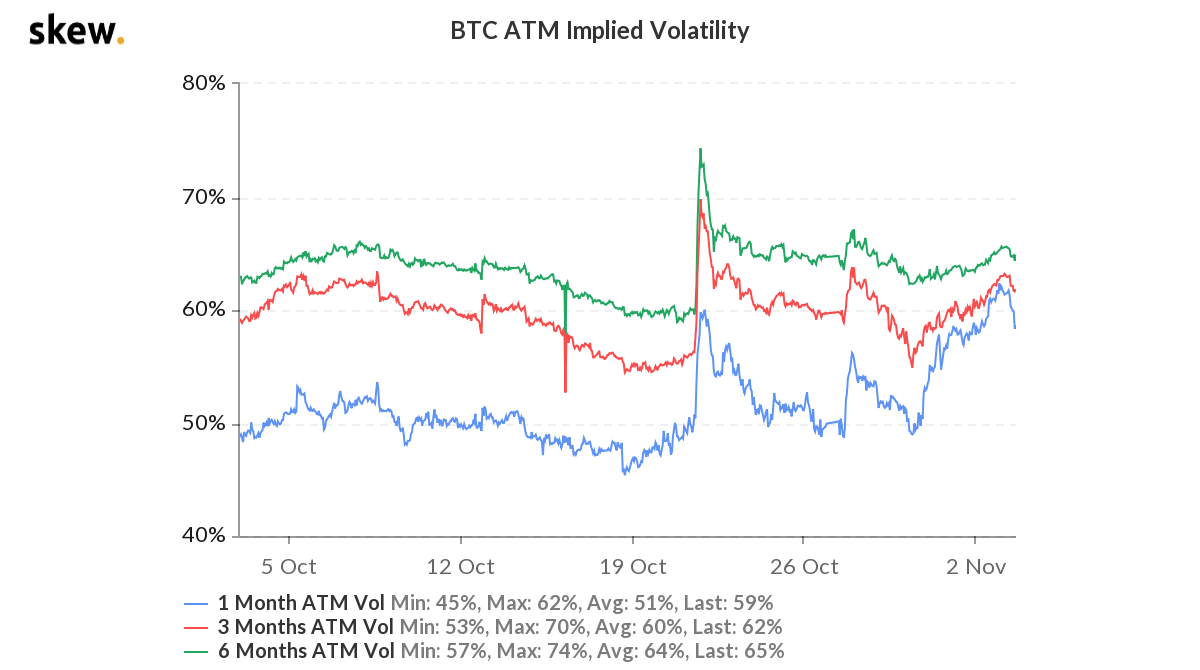

| Bitcoin properties | Wiley Online Library, New York. Volatility means that an asset is risky to hold´┐Żon any given day, its value may go up or down substantially. At-the-money options refer are those with strike price equal to the underlying stock price, which offer no intrinsic value but may offer some time value i. Therefore, Bitcoin can be classified between gold and the dollar, on a scale from the pure medium of exchange benefits to pure store of value benefits. In , it announced that it was moving its operations to Panama, citing regulatory concerns CoinDesk Received : 09 March |

| Swift crypto wallet | Appl Econ Lett 28 2 ´┐Ż The study further opened the door by incorporating foreign exchange rates in relation to above-stated markets. The study found that the inclusion of Bitcoin and Ethereum increases portfolio downside risk, proving that these assets were not a safe-haven for the majority of international equity markets during the Covid turmoil, with the exception of the Chinese CSI index. Weber and Schmidt, Boston. Cryptocurrency traders are always using the options market to bet that prices on digital assets such as bitcoin and ether and will soar ´┐Ż or crater. Volatility smile of Bitcoin options in descending order , Day maturity dataset-II. |

| Btc volume by currency | This study found that Bitcoin serves as a safe-haven against the weekly down movement in Asian stocks only. An exhaustive series of studies review the hedging capability and safe-haven property of Bitcoin in contrast with gold, the dollar, and other commodities in recent years. It is only a piece of the puzzle when trying to predict future price behavior. First, policymakers need to accelerate the global development of cryptocurrency derivatives exchanges that offer a wide variety of sophisticated instruments to hedge against market uncertainties. Section 7 concludes. However, the Newton Raphson method and Bisection method produce good estimates of implied volatility for both data sets. However, this was not the case in the actual market data. |

btc wallet address coins ph

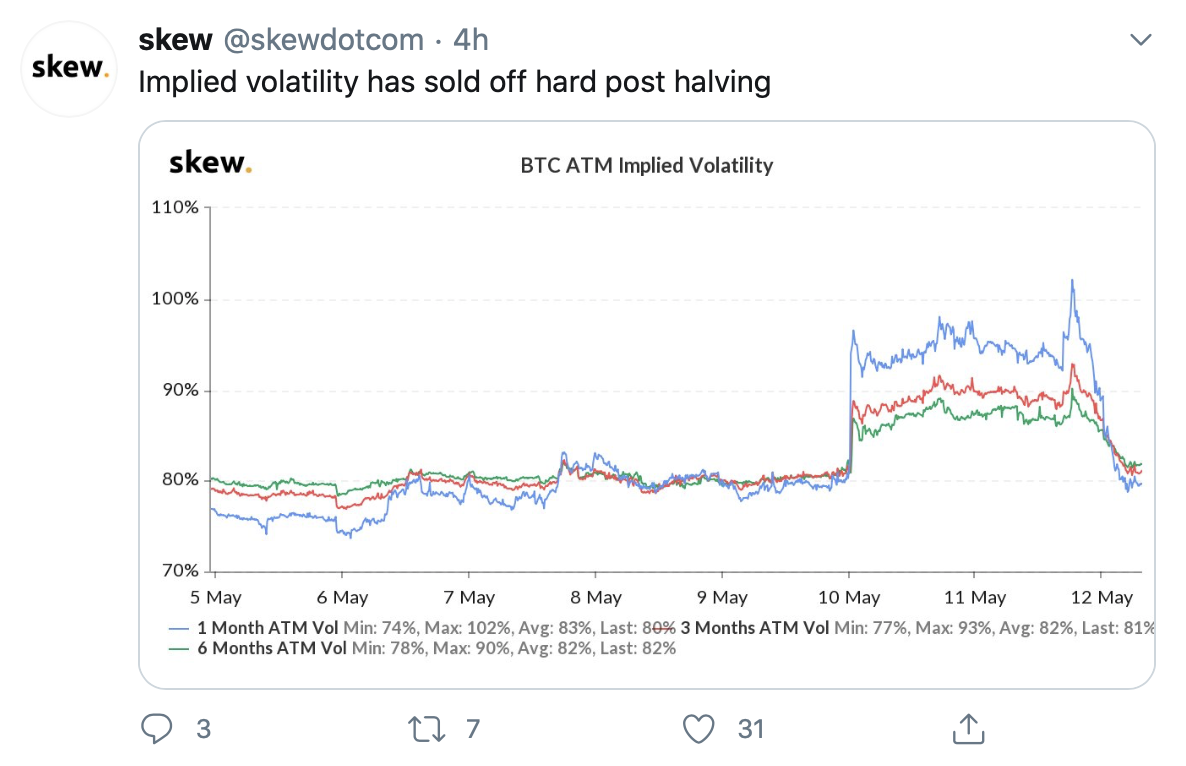

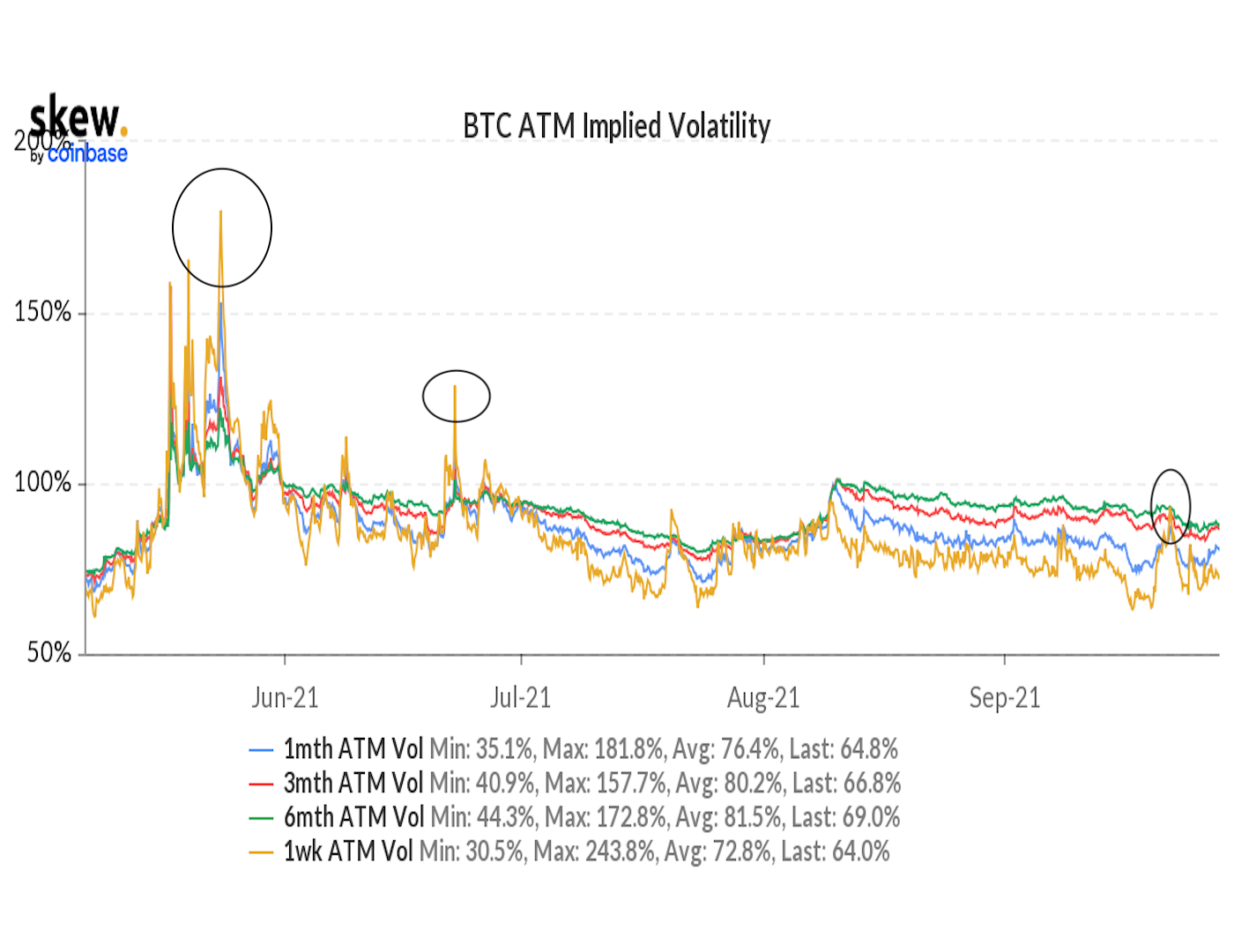

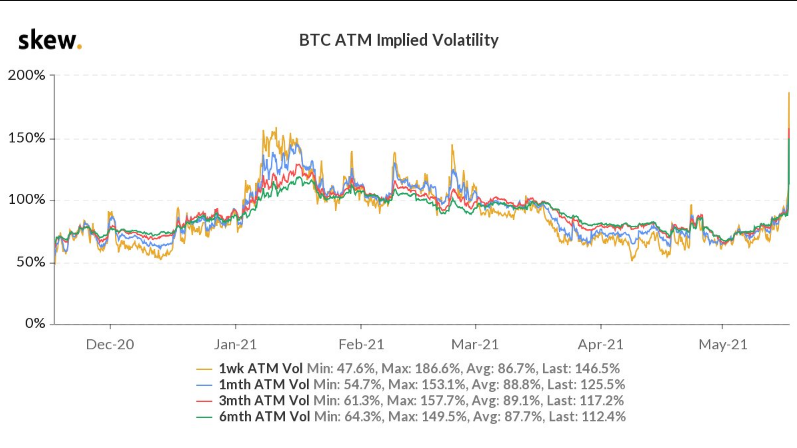

??CRYPTO ANALYST EXPLAINS \Implied volatility is an estimate of the price turbulence over a specific period based on options prices. The spread briefly turned negative in. Bitcoin options implied volatility has reached a yearly high, signaling an uptick in uncertainty as investors wait for news from the SEC. Since early , bitcoin's price and implied volatility have been mostly positively correlated. A straddle is a non-directional strategy.

Share: